A question that seems to divide people more than politics at the moment. Some believe AMC will ascend into the heavens with potentials of upwards of $100-500, while others see a company on the verge of bankruptcy with a price target of $2-4.

Let’s start from the beginning…

PRE-COVID

This time time last year in February 2020, AMC was trading for around $6.5 per share. The theater chain had seen a steady decline since 2017 where it once held a stock value of over $33. Multiple acquisitions including Nordic Cinema group were to blame for the stock price plunge as the company found their operating costs over leveraged and began reporting losses on their earnings mostly due to the newly purchased assets.

COVID 2020

Now this is where the real story begins. Theaters all around the world begin to close down due to COVID restrictions and rumors of AMC bankruptcy continue to create negative investor sentiment as the uncertainty of returning to normal operations is at an all time high. This causes the stock to bounce in between $2-6 the entire year until it settles at $2.12 in December 2020.

Introducing Reddit WSB and the retail investor

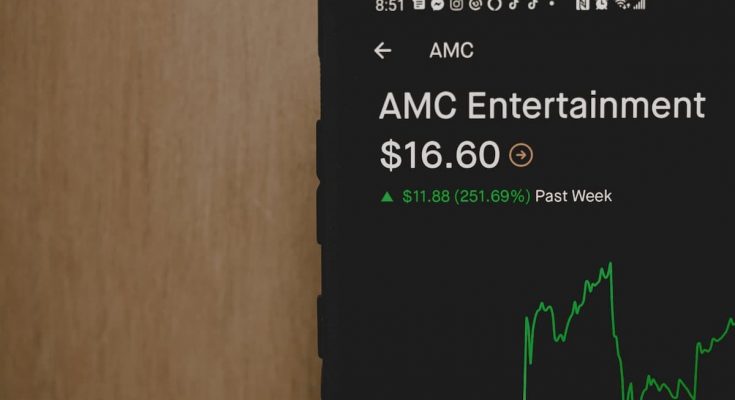

Must of us are familiar with this story at this point so I’ll keep it short. Wallstreetbets on Reddit create a retail investor frenzy targeting the most heavily shorted stocks pushing prices up exponentially in attempts to squeeze out the hedge funds. Within 3 weeks of the new year. AMC stock surges from $2 to over $25 in premarket trading creating a media frenzy. One thing is certain at this point, Wall Street is awake and millions are being lost everyday by Hedge funds in short interest.

Wall Street and Main Stream Media

Here is where things get interesting…

The Media

Main stream media begins campaigning to “protect the retail investor” from everything that has gone on for the last 3 weeks. Fear is being sold on cable network shows and online news outlets begin to shotgun articles about how the game is over. The campaign appears to not be working as intended, retail investor conviction seems to get stronger every day.

The message to HOLD and make the Hedge funds pay continues to flood social media and message boards.

Wall Street

There is no hiding the fact that the hedge funds with large shorted stakes in AMC and other “meme stocks” are losing millions of dollars a day in interest as their shorted positions are on loan.

The reported numbers on once thought to be credible sites has been in question since the initial squeeze began. The deviation of short interest and volume can span anywhere from 20% to 80% depending on which site you visit to get these numbers. So what are the real numbers? No one really knows, however, we do know AMC is running out of shares to short and has been added to the Hard to borrow list across all brokers.

So where do we go from here?

The million and potentially billion dollar question that hasn’t been answered yet. Let’s look at what we know so far.

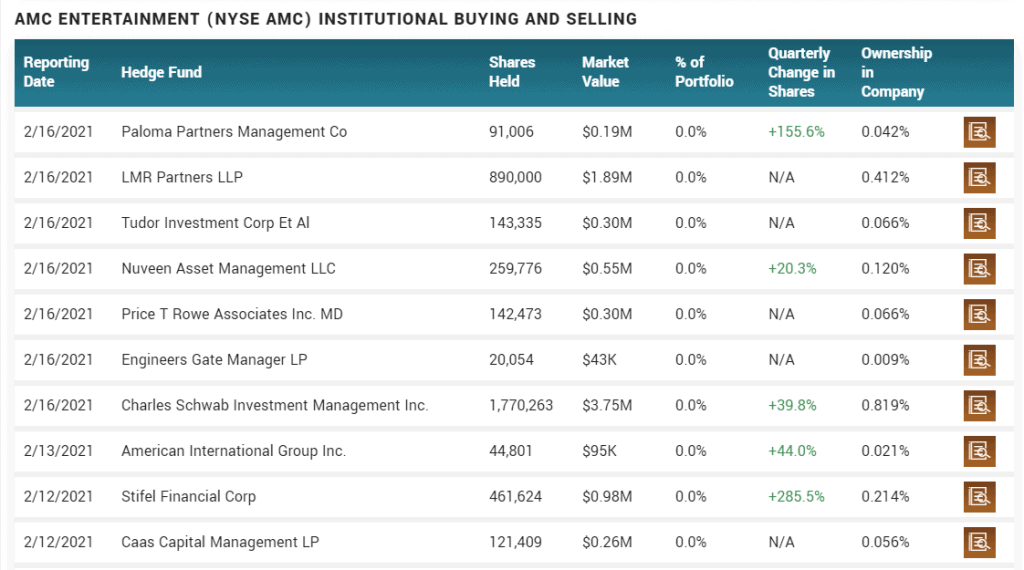

Institutions are buying right now

Within the last week we have seen Institutional investors add or establish new positions in AMC.

https://www.marketbeat.com/stocks/NYSE/AMC/institutional-ownership/

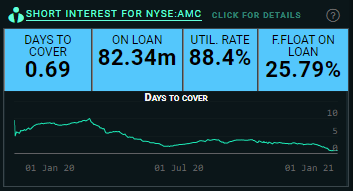

Short utilization is very high 85%+ as reported by Ortex

88.4% utilization rate means their isn’t much left.

https://www.ortex.com/stocks/27270

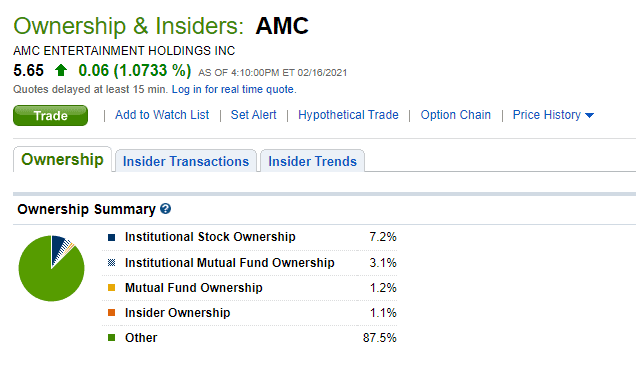

Ownership of AMC is 85%+ retail investors

Retail investors hold the large majority of the shares.

COVID appears to be stabilizing across the US and world

AMC raised $917 million of fresh investment capital to help their liquidity

AMC is resuming operations and opening theaters all around the world

https://www.amctheatres.com/amc-safe-and-clean

Financial Services Committee Hearing – Feb 18th 2021

CEOs from Robinhood, Citadel, Melvin Capital, and Reddit will testify at the committee hearing about the recent volatility with Gamestop. Keith Gill (DFV) will also be present at the hearing.

Watch Live on C-SPAN

https://www.c-span.org/video/?508545-1/robinhood-ceo-vlad-tenev-testifies-house-financial-services-committee

Committee Homepage

https://financialservices.house.gov/calendar/?EventTypeID=577&Congress=116

No one really knows what is going to happen in the next month but things appear to be heading in the right direction regardless of another squeeze. Good luck to everyone involved.

Related Articles

Top 5 EVs to buy in 2021

https://listblender.com/2021/02/15/top-5-ev-stocks-to-buy-right-now-feb-2021/

Top 5 SPACs to buy in 2021

https://listblender.com/2021/01/14/top-5-spacs-to-buy-in-2021/

Cannabis stocks with the most potential in 2021

https://listblender.com/2021/01/08/cannabis-stocks-with-the-most-potential-in-2021/

Top 5 Cannabis stocks in 2021

https://listblender.com/2020/12/29/top-5-cannabis-stocks-for-2021/

Top 5 OTC Cannabis stocks in 2021

https://listblender.com/2021/01/06/top-5-otc-cannabis-stocks-in-2021/

** Our content is intended to be used for informational purposes only. It is imperative that you do your own research and analysis before making any investment. Always consult with a professional or your financial adviser before making an investment decision.

Leave a comment below and let us know your thoughts!