It’s no secret that Canadian Cannabis companies have been dealing with their fair share of struggles for the last few years, but recent changes in executive management at Sundial Growers have proven to strengthen its financial position within the market. The recent elimination of its outstanding debt, partnership with Choklat cannabis chocolates, strategic partnerships with Solventless Concentrates, and the launching of new premium derivatives via Top Leaf are indicators of the company moving in the right direction.

Sundial is still trading under $1 at the moment; the company has until June 2021 to regain compliance with the Nasdaq bid requirements. Trading a stock at risk of delisting certainly presents its own set of risks, but there seems to be a very bullish sentiment with shareholders of SNDL. There are many catalysts in 2021 that could easily boost the entire cannabis market and Sundial would benefit greatly if they continue to capitalize on their retail brands and strategic partnerships.

Sundial provides high risk with potentially high returns as there is a lot of room on the upswing. Let’s not forget this was trading over $3 less than 1 year ago.

Recent company news

- Prospectus Supplement filed indicating the company may offer and sell common shares having an aggregate offering price of up to US$50,000,000 from time to time through Canaccord Genuity LLC.

- Sundial has launched premium cannabis derivative products under the Top Leaf brand.

- Acquisition of $58.9 million of Zenabis Investments senior secured debt. The note has an annual interest rate of 14% and is due by March 31, 2025.

- Sundial entered into a license agreement with Simply Solventless Concentrates Ltd. for the processing and manufacturing of a suite of solventless cannabis concentrates products by Sundial in its Rocky View facility using SSC’s intellectual property.

- Sundial is debt-free, following the prepayment of the remaining outstanding principal under its senior secured non-revolving term credit facility of $21.9 million. As of today, no debt remains outstanding.

- The company received approval to transfer the listing of its common shares to the Nasdaq to take advantage of the additional 180 calendar day compliance period offered on the Nasdaq Capital Market, which will extend the period to June 26, 2021.

Potential price catalysts

- Democrats securing Georgia Senate seats to gain control of Congress.

- Biden presidency is expected to move towards federal legalization of marijuana in the US.

- Sundial’s most recent offering would be used to pay down debt, to finance possible acquisitions or invest in equipment, facilities and for general corporate purposes.

- Sundial regains minimum bid price compliance before the June 2021 deadline to avoid delisting or R/S.

- Strategic acquisitions or a merger with another company.

- Share dilution due to additional shelf offerings.

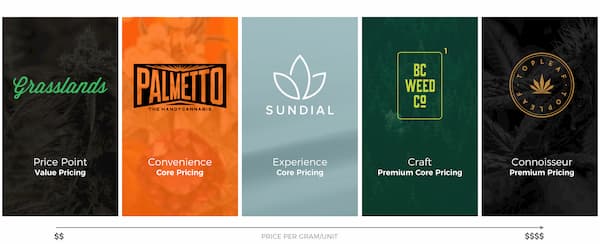

Portfolio of Brands

- Sundial Cannabis

https://www.sundialcannabis.com/ - Top Leaf

https://www.topleaf.ca/ - BC Weed Co

https://bcweedco.com/ - Palmetto

https://www.palmettocannabis.ca/ - Grasslands Cannabis

https://www.grasslandscannabis.ca/

Sundial also owns 50% of Pathway RX Inc, a medical cannabis business with plans for an innovative e-commerce marketplace.

Sundial and Choklat launched a cannabis-infused confectionary brand, offering a selection of chocolate bars, drinking chocolate and infused sugar, all containing 10 milligrams of THC, the highest amount legal to sell in a single edible serving in Canada.

Resources

SEC Filings for SNDL

https://www.sec.gov/cgi-bin/browse-edgar?CIK=1766600&owner=exclude

https://www.nasdaq.com/market-activity/stocks/sndl/sec-filings

Motley Fool – SNDL

https://www.fool.com/quote/nasdaq/sundial-growers/sndl/

MarketWatch – SNDL

https://www.marketwatch.com/investing/stock/sndl?mod=quote_search

Seeking Alpha – SNDL

https://seekingalpha.com/symbol/SNDL

Yahoo Finance – SNDL

https://finance.yahoo.com/quote/SNDL?p=SNDL&.tsrc=fin-srch

Bloomberg – SNDL

https://www.bloomberg.com/quote/SNDL:US

Company Information

Company Website

https://www.sndlgroup.com/

Quarterly Financials

https://www.sndlgroup.com/investors/financial-results

Headquarters

#300, 919 – 11 Avenue SW. Calgary, AB

CEO

Zachary George

President & COO

Andrew Stordeur

CFO

Jim Keough

Related Articles

Cannabis stocks with most potential in 2021

https://listblender.com/2021/01/08/cannabis-stocks-with-the-most-potential-in-2021/

Top 5 Cannabis stocks in 2021

https://listblender.com/2020/12/29/top-5-cannabis-stocks-for-2021/

Top 5 OTC Cannabis stocks in 2021

https://listblender.com/2021/01/06/top-5-otc-cannabis-stocks-in-2021/

** Our content is intended to be used for informational purposes only. It is imperative that you do your own research and analysis before making any investment. Always consult with a professional or your financial adviser before making an investment decision.